Corporate Governance

Basic Approach

The Company's basic approach to corporate governance is to engage in fair, logical, speedy decision-making on the basis of collaborative creation with shareholders, users, employees, business partners, local communities, and other stakeholders for the purpose of enhancing corporate value.

The Company has a basic policy of seeking balance between the decision-making and business execution function and the management oversight function to support appropriate management decisions and business execution by the president and CEO, who is also a major shareholder.

The Company has established a "Philosophy" consisting of our mission, vision, and principles, and is promoting its penetration throughout the Group. The Company is also promoting the "Portfolio Strategy", a growth strategy to realize the vision. Please refer to the following.

Cross-Shareholdings

The Company's policy is to acquire shares of publicly listed companies for strategic purposes only when it can be reasonably explained that said shares are strongly tied to business, such as a capital and business alliance, and that such alliance proceeds more smoothly as a result of the holding of shares.

After the acquisition of shares, the Board of Directors periodically examines the effectiveness of said alliance, taking into account any change in the appraised value of the shareholding.

With regard to the exercise of rights, since the relationship is usually a capital and business alliance, the Company basically approves the proposals of the issuing company provided there is no conflict with the Company's interests.

Adoption of Anti-Takeover Measures

Not adopted.

Related Party Transactions

The Company's policy on related party transactions is for the Board of Directors to discuss and decide the appropriateness of transaction terms and conditions and of how they are determined.

Even after a Board of Directors decision, the accounting and internal audit departments perform an ex-post facto examination of transaction content and other details.

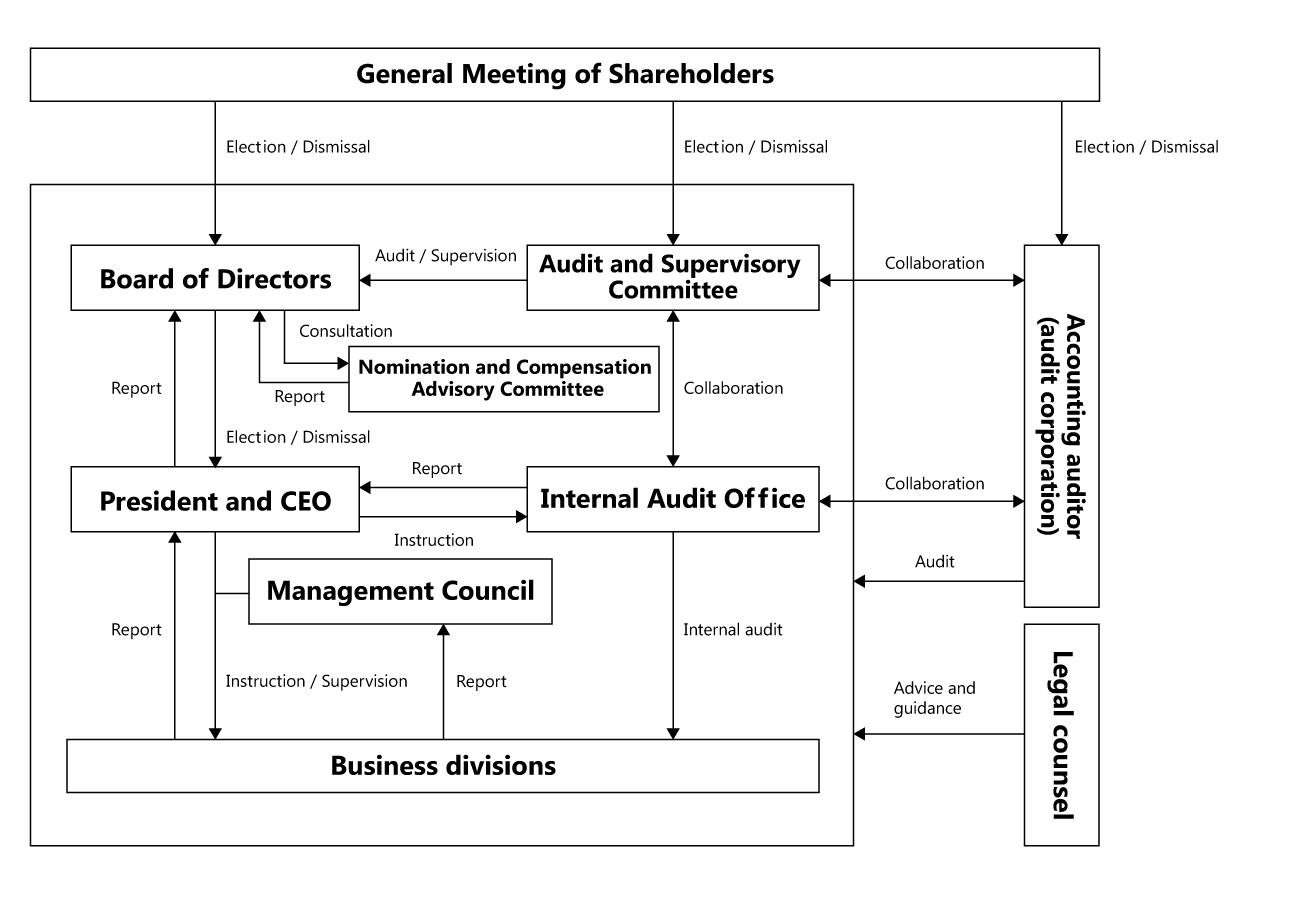

Corporate Governance System

The Company has adopted a company with Audit and Supervisory Committee. The four Audit and Supervisory Committee members are all outside directors who have a wealth of practical experience and professional knowledge: an experienced corporate officer at other companies, a certified public accountant and licensed tax accountant, and an attorney at law.

Five of the directors are outside directors under the Companies Act.

Since the industry in which the Company operates is still in its growth stage and competition with other companies is fierce, it is necessary to expeditiously execute the business strategy. In these circumstances, the Company has adopted this governance system in the interest of ensuring management transparency and soundness in order to earn public trust.

Corporate Form of Organization

Audit and Supervisory Committee

Outline of Corporate Governance structure

Board of Directors

The Company's Board of Directors consists of fourteen directors: two representative director, eight directors who are not Audit and Supervisory Committee members, and four directors who are Audit and Supervisory Committee members. Three of the directors who are not Audit and Supervisory Committee members and the four directors who are Audit and Supervisory Committee members are outside directors under the Companies Act. To ensure efficient, speedy decision-making, the Board of Directors holds regular meetings once a month and extraordinary meetings as necessary. The Board of Directors functions as a management decision-making and supervisory body pursuant to the Articles of Incorporation, laws and regulations.

Audit and Supervisory Committee

The Company's Audit and Supervisory Committee consists of four Audit and Supervisory Committee Members, of whom all are external Audit and Supervisory Committee Members. One of the Audit and Supervisory Committee Members is a certified public accountant and tax accountant, and one is an attorney at law. The Audit and Supervisory Committee Members attend meetings of the Board of Directors and other internal meetings and from time to time express opinions about directors' performance of duties. The Audit and Supervisory Committee Members conduct audits based on the audit plan, and the Audit and Supervisory Committee holds meetings once a month and extraordinary meetings of the Audit and Supervisory Committee as necessary. The statutory auditors share information necessary for auditing by periodically holding meetings with the Internal Audit Office and the accounting auditor.

Management Council

The Company seeks to ensure management transparency by holding meetings of the Management Council once a week, in principle, where important decisions other than matters for resolution by the Board of Directors and reporting matters from the business divisions are introduced and discussed.

Nomination and Compensation Advisory Committee

The Company established the Nomination and Compensation Advisory Committee with the aim of ensuring objectivity and transparency in the process of determining nomination and compensation for directors and further strengthening the corporate governance system. The Committee reports on drafts concerning the nomination of directors, including the appointment and dismissal of directors, and the compensation system and individual allocations.

Accounting Auditor

The company has entered into an audit agreement with Deloitte Touche Tohmatsu LLC and undergoes audits under the Companies Act and the Financial Instruments and Exchange Act.

Disclosure and IR Activities

COLOPL's Approach to Investor Relations

To COLOPL, shareholders and investors are essential partners and key stakeholders. Investor relations (IR) activities support and ensure the building of good relations between the Company, a stock issuer, and its shareholders and investors. Although IR activities are generally considered to be the provision of information from issuers to shareholders and investors, COLOPL considers the active solicitation of opinions and questions from shareholders and investors and their application in management and business activities are another form of IR activities. The foundation of what COLOPL considers ideal investor relations is described in the definition offered by the Japan Investor Relations Association and the National Investor Relations Institute of the U.S.

Investor relations is a strategic management responsibility that integrates finance, communication, marketing and securities law compliance to enable the most effective two-way communication between a company, the financial community, and other constituencies, which ultimately contributes to a company's securities achieving fair valuation.

National Investor Relations Institute (NIRI)

In other words, the objective of IR activities at COLOPL is "achieving fair valuation of a company's securities." To achieve fair valuation, investors must make appropriate investment decisions. This means that investors forecast a company's business performance and form an impression of what figures for the P/E ratio and other investment indicators are appropriate: that is, investors themselves perform stock valuation. The fundamental principle of equity investment is simple: investors compare their own impression of a stock's value with the market price. In order to give significance to this simple principle, COLOPL intends to continuously provide shareholders and investors sufficient, easy-to-understand information through IR activities. We intend to continue to work diligently to build good relations with our shareholders and investors through IR activities in order to contribute to fair valuation.

Basic Policy on Information Disclosure

The Company discloses information in an accurate, fair, and timely manner in accordance with the Financial Instruments and Exchange Act and other laws and regulations and the Timely Disclosure Rules stipulated by the Tokyo Stock Exchange. The Company endeavors to proactively and fairly disclose information that it deems valuable to shareholders and investors, even if it does not constitute a material fact as stipulated in the Timely Disclosure Rules, through the corporate website and other media.

IR Activities

Dialogue with shareholders is overseen by the director in charge of IR. In addition to holding quarterly meetings for institutional investors on the day of the announcement of financial results to provide a direct explanation of the company's performance from management, the Company also strives to enhance communication by holding individual meetings with institutional investors and attending conferences organized by securities companies.

At meetings of the Board of Directors, the directors relay opinions and concerns obtained through dialogue with shareholders that they consider important in their reports about the divisions under their charge. The Company has developed a system for the immediate sharing of matters requiring urgency between the CEO and the directors in charge.

When engaging in dialogue with shareholders, the Company gives due consideration to insider trading regulations. In addition, the Company endeavors to record and save the content of meetings, e-mails, and telephone calls with shareholders to manage and utilize the information from the dialogue.

Corporate Governance Report

Please refer to the following.